p2p investing

There are 16 posts filed in p2p investing (this is page 1 of 2).

P2P crowdfunding portfolio

My p2p investing journey began in 2015 July when i have made first investment in Bondora.

171.015 euros invested

Later on I have tested 10-15 platforms. In the beginning it was consumer lending and later I have realised that they are too risky and stuck to only Real Estate platforms. Though to this day I still have positions in Mintos and Bondora.

I have stopped all auto-invest strategies leaving only EvoEstate active auto-invest setting for Skin in the Game projects.

Defaults on EstateGuru

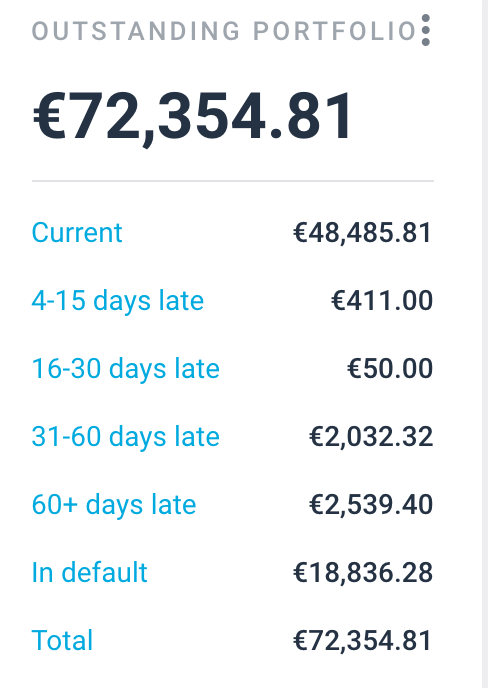

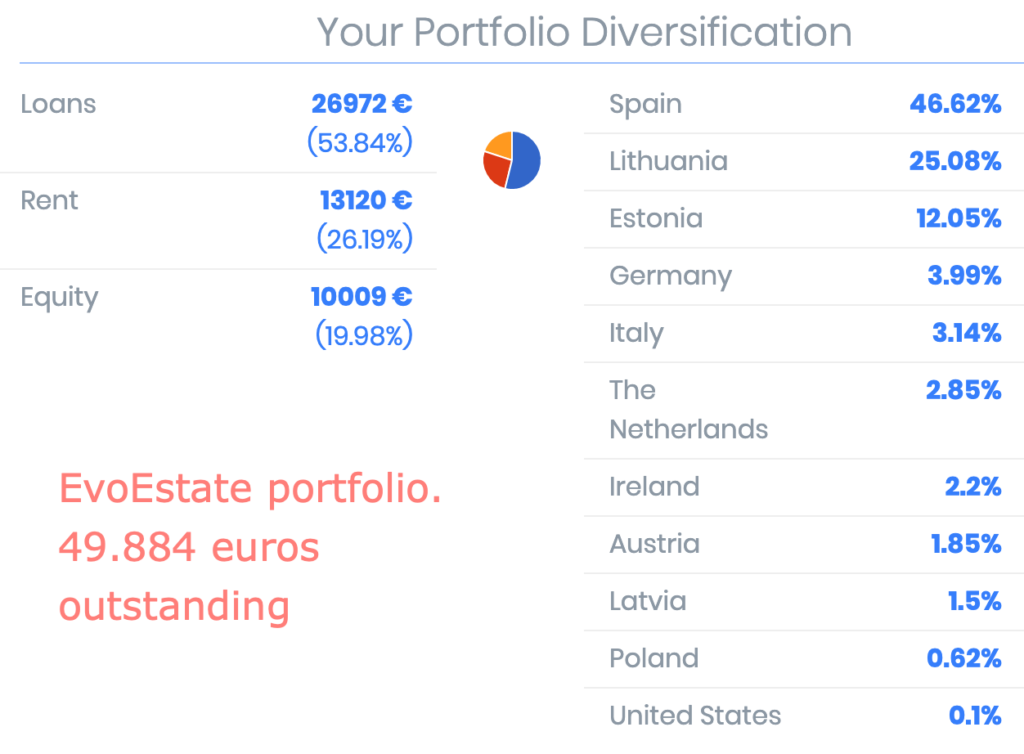

I have already had few defaults on EstateGuru and with this post I want to share how the defaults happen and what you can expect. (i have previously shared how Housers manage defaults) The image is my current portfolio stats with the defaults. I have stopped investing in EstateGuru some 6 months ago, as I am currently putting all my Real Estate investments into EvoEstate.

To this date EstateGuru claims they have not lost any principal for the investor. With the rising Real Estate market that was quite easy to sell the defaulted properties for greater value. It is not clear how much does the recuperation of defaulted loans cost for investors. So I give my personal examples:

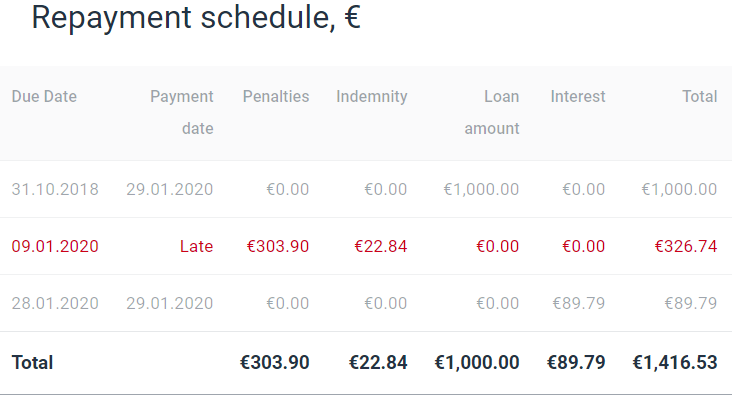

Tiskre residences development loan II. 12 month loan with LTV 57% and expected 10,5% annual interest. I got €89.79 which comes to 8,98% total return in 820 days and annual REAL return less than 4%

I have other 8 loans that defaulted – on the contrary all those 8 have returned bigger return than expected. (That happens because if the borrower is late – he starts being charged 18% annual interest rate.)

How long does it take to recover defaulted loan?

In my experience usually it is about 1 year, but i have properties that take longer. The thing why this happens in my opinion is that EstateGuru does not want to lose investors principal, so they do not lower the auction start price enough.

The last auction failed due to lack of interested buyers. The new auction will be announced soon with same price.

defaults on Housers

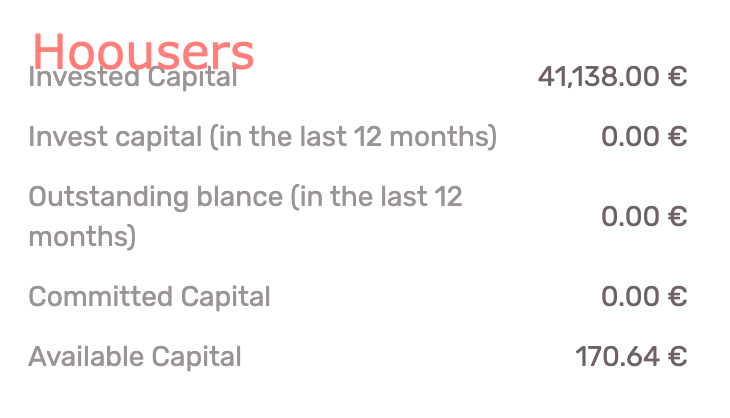

I have been investing in Housers for more than a year now. My experience with Housers was negative at the beginning and then I have changed my mind and re-ranked it.

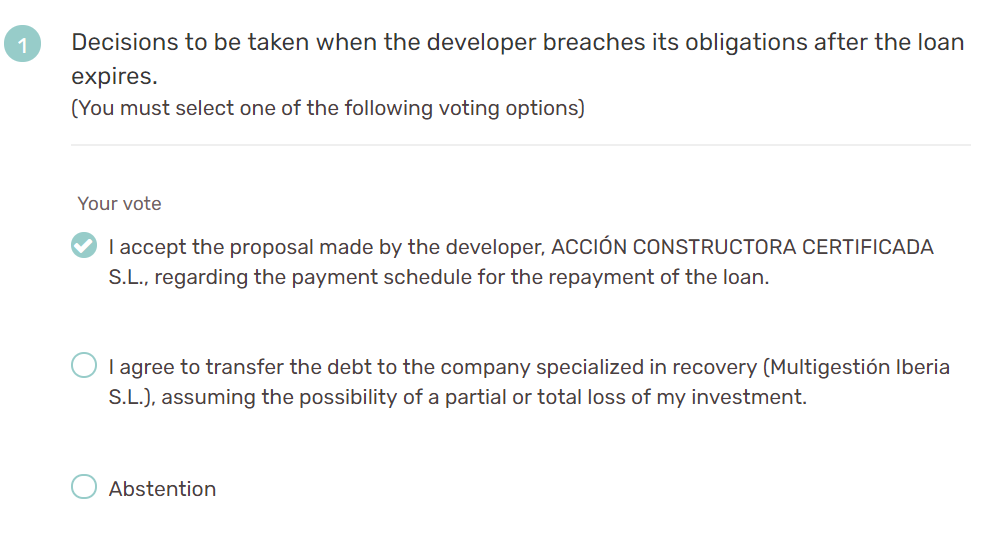

Now I have new experience – default. Defaults are usual in lending industry. The risks and how they are managed – that is what is interesting in this case: MARISMAS DE ODIEL

535k loan was taken with 11,5% yearly interest rate for period of 6 months on July of 2018. 3,5k of interest was paid.

The interesting part is that Housers asked every investor to vote what to do next.

I like the idea that everybody is allowed to control their fate, but on the other hand, Housers, with 80+ of staff could prepare some analysis and give their opinion on what is better to do.

Another interesting about this Spanish default is that Housers outsource recovery of money for a hefty 12% + VAT fee. (additionaly Housers pays 1.5% from their pocket)

So investors in this project had two options:

- A. prolong interest (with lower interest rate!!!)

- B. give for management company the right to recover the debt.

Customer support is terrible. 3 emails sent. No reply. Phone call 3 minutes hold – no answer = promise to call me back.

p.s. Housers earned 8.5% on raising this loan.

MEDITERRANEAN HILLS. Project was funded 2018 July 18th for 12 month loan with 8,5% interest. 2020 April 24 the project still does not have a building license. Same situation is with Bond Hills where same developer NOK (run by GARRIGOS ZAMBUDIO ANA BELEN) did not get the license in 2 years to start construction.

BELLEVUE GREEN 2020 April 1st – 2 month notification is given to present new schedule. June 6th nothing happens

HONLY HOTEL. Property funded December 12, 2018 for 12 month loan. It paid interest for 4 months. No more communication from Housers side.

P2P portfolio update 2018.10 – 2019 04

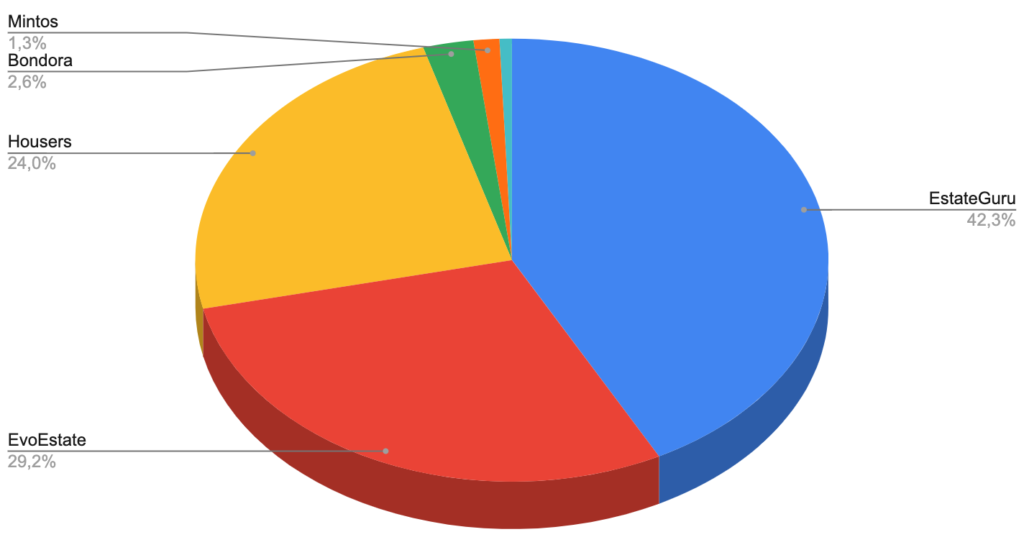

The biggest update of my P2P portfolio is that i am reducing allocations in platforms, as I have started EvoEstate.com – Real Estate only, European p2p aggregator. I am moving my own funds to the company, where I will have greater platform diversification and thus minimise risk and have less paperwork.

Continue readingP2P portfolio update 2018.04 – 2018.10

26% of my networth is invested in P2P Continue reading

P2P portfolio update: 2017.10 – 2018.04

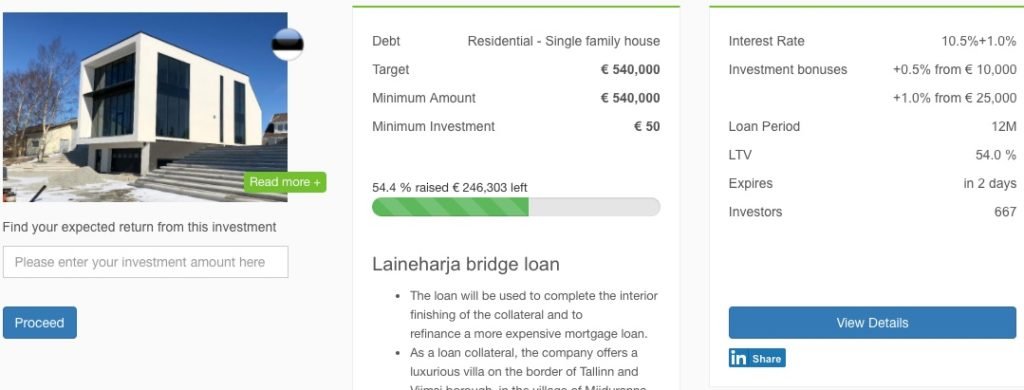

EstateGuru. I have increased my allocation to 7.5% of my net worth in this platform. Turned off the auto-invest and doing investment manually. I have contacted support for improving the service with more abilities to filter the auto-invest settings, but they refused to do that. I see the biggest risk in projects, where collateral is Land (I rarely invest manually to Land collateral) or some risky projects such as:

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it.

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it.

All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.

All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.

EstateGuru is the first P2P lending company I recommend to my friends

Bondora. Doing nothing with the account. Auto-invest is turned off. Waiting for more results from #strategy3. After 15 months from the start of this experiment I am approaching 50% mark of defaults. I know that 60% default rate would still bring me good return, but i have a feeling that i will have 70-80% of default from strategy3. The good thing that i put only 0,5% of my networth into this strategy testing, and still with the 75% default rate i think i would not lose the money.

Mintos. I have increased my allocation in this platform to 2.5% of net worth. I converted to all the possible currencies and split the risk between different platforms, currencies. Majority of operators i took those who offer collateral. The bad thing i did i exchanged too many DKK and 80% of this currency sits idle, and none of investments available in both primary and secondary market.

Twino. My lowest allocation.

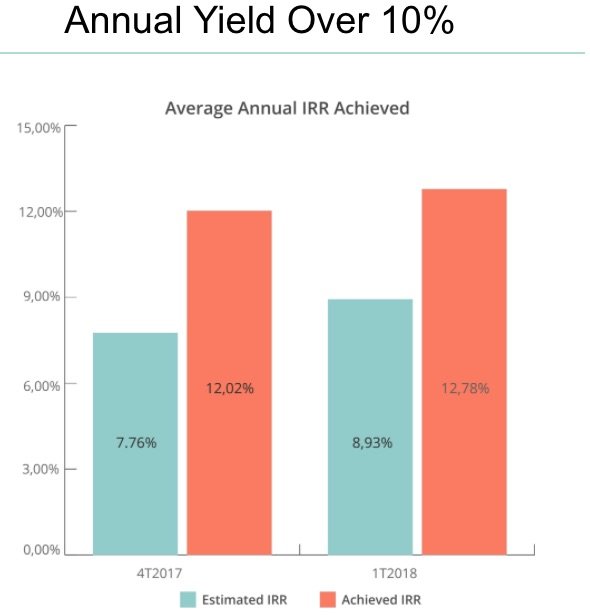

Housers. They are pushing good ads. I liked especially the one that they claim that real returns are greater than expected. Still they do not convince me

1 year with Bondora Strategy #3

I have started investing in Bondora in August of 2015 and noticed that loans that default, usually default on first payment. Therefor I came up with strategy #3: invest in HR (high risk) loans, with interest rate 50%+

After almost 12 months, i have following results:

Total loans 523 (473 not repaid yet) loans purchased, with 5483€ of principal and 73% interest rate.

Defaulted 109 loans, with principal of 1388€ and interest rate of 75%

So it comes that only 25% of loans defaulted during first year with average interest rate of 74%.

On one hand it seems it should make extremely good returns, but on the other hand the current cash flows does not add up. If i count the cashflows in a simple diminishing way and multiply it by 5 years, the total amount returned will not generate return an might have negative return.

p.s. how do i chek what return i have made on repaid loans ? (523-473=50 repaid loans)

—

I do not find an answer if my strategy is good or bad. I even tried manual XIRR calculation suggested by P2P-Banking for all of my portfolio, and I got following results:

Housers investment

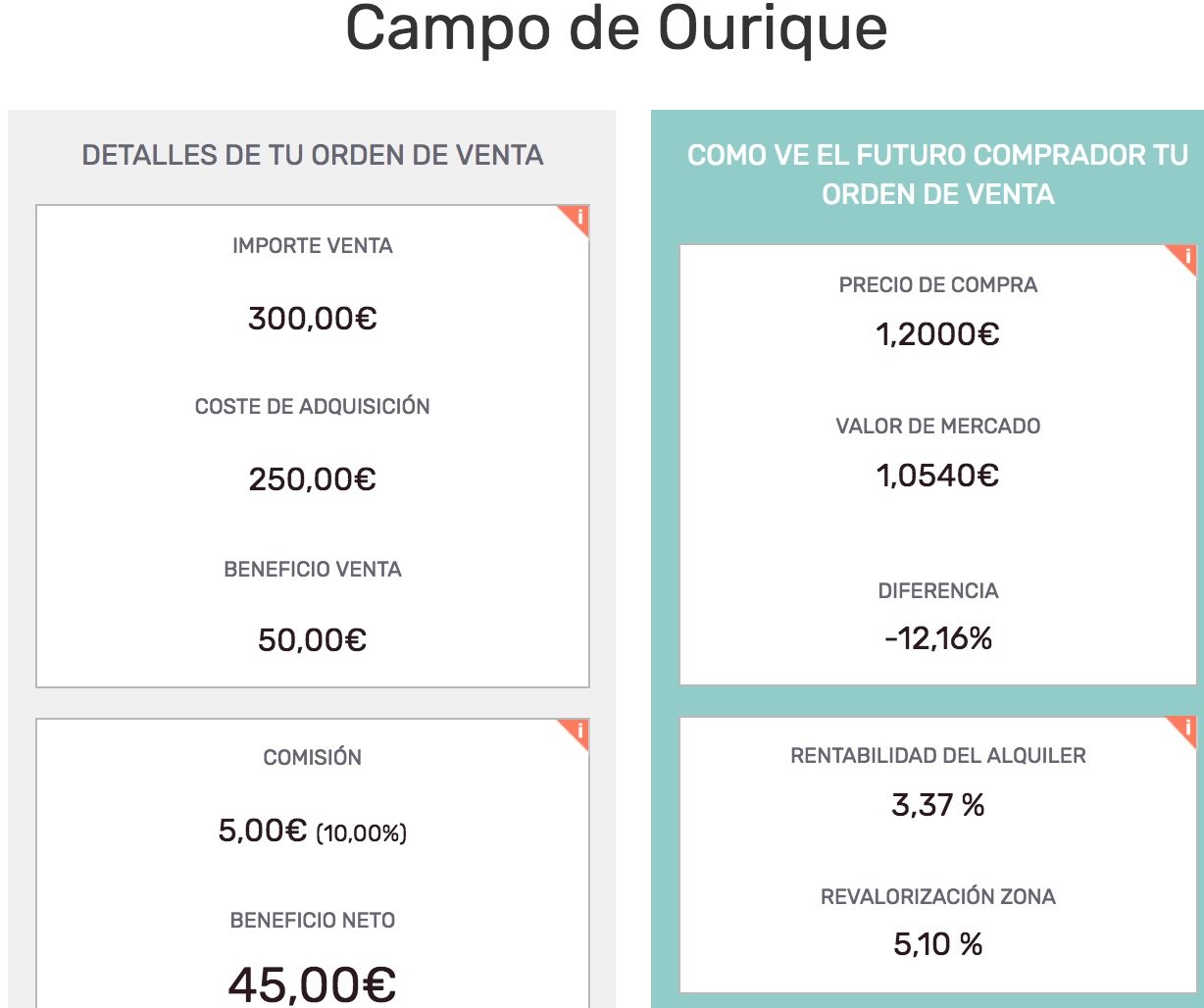

I was very bearish on Housers, both as a platform and as equity investment, but as i had 1000€ in the platform after difficulties putting money there, I have invested in 4 projects and after one year i will try to see what the true return will be, as in my opinion.

One thing i see that is already missing in the system is AutoInvest, because i see that i will get monthly returns so i will have to re-invest it manually.

after acquiring 4 projects for 250€ I put them on resale immediately with 20% markup. And in my surprise someone has bought one of my projects and i made 18% return on one property in few months.

P2P portfolio 2017 Q3

Bondora. I did not make additional deposits to Bondora, but I have reinvested profit to #strategy3 High Risk loans. 157 loans for 2148€. Average return 78%. My total size of #strategy3 is 3428€ in almost 300 loans. Only 48 of them defaulted bringing 550€ of loss. My strategy works. Isn’t it ? 🙂 (net return on dashboard 10.2%)

Mintos. Less than 1% of bad debt – actually 0,16%. 12.95% return. During this period Mintos added new new loan originators from Bulgaria, Botswana and Czech Republic. I think i will ad 3k: 1k to each new country/originator. *mintos review

Twino. Their system is fucked up. I see 927€ cash idle. Trying to find loans – have one match. Return 11.99%

Housers. Deposited 1000€ but did not make any investment yet.

Brickowner. Deposited 1000GBP. Made one investment of 100.

Plan for 2017 Q4: Open 3 more accounts.

p.s. found a way to invest idle cash in Twino: created the auto-invest portfolio. 11% with buy-back guarantee in Kazakhstan