| Fund2 | noticible event | ||

|---|---|---|---|

| 2017 September | BilliontoOne (seed) | Prenatal testing for every expecting mother | Raises Series A Raises Series B. Raises 125M Series C |

| 2017 October | Locus Biosciences (series A) | CRISPR-Cas3 Biotech Drug Development | Announces 818M deal 6B shot at making new antibiotics. WIRED 2022 35M financing round |

| 2018 February | Orphidia | Universal Platform For All Blood Tests | Technically bankrupt. |

| 2018 March | Mycroft AI | Alternative to Amazon Alexa. Opensource | Operating |

| 2018 October | Wisp | D2C for preventing Herpes | My first real EXIT. 21x in 3 years Public telemedicine company acquires WISP |

| 2019 January | Find a lawyer | Lawyers marketplace | Bankrupt |

| 2019 January | EvoEstate (investor and founder) | Real Estate investment platform | Merged with InRento , where I remain shareholder |

| 2019 March | Bikeep | Protecting bikes from thieves. Saas for bike sharing | Operating |

| 2019 June | NorthOne (seed) | Online bank for Business in Canada (USA) | Raises Series-A in 2020 2022 Raises 67M Series B. Tencent as lead investor |

| NOW | Your startup | Need cash or web development services? | Pitch me! |

| Fund 1 | 2014 - 2016 | |

|---|---|---|

| 2014 | Wefunder | exited with 7% roi |

| 2014 | BoxC | operating |

| 2014 | Soothe (seed round) | Skipped Series A. Participated in series B. Skipped Series C |

| 2014 | Enevo | Skipped next round. Went Bankrupt after Series C. |

| 2015 | Italist | operating |

| 2015 | Molekule (pre-seed) | Raised multiple follow up rounds. (Seed, Series A, B) Did not invest bc did not have pro-rata rights. 2022 Raised a down round where my investment was divided by 16x |

| 2015 | Skyfront | operating |

| 2016 | Revolut (Series A) | Received 20x cash offer. Still holding position. After last private financing round my position had 300x return |

| 2016 | Gone | Bankrupt |

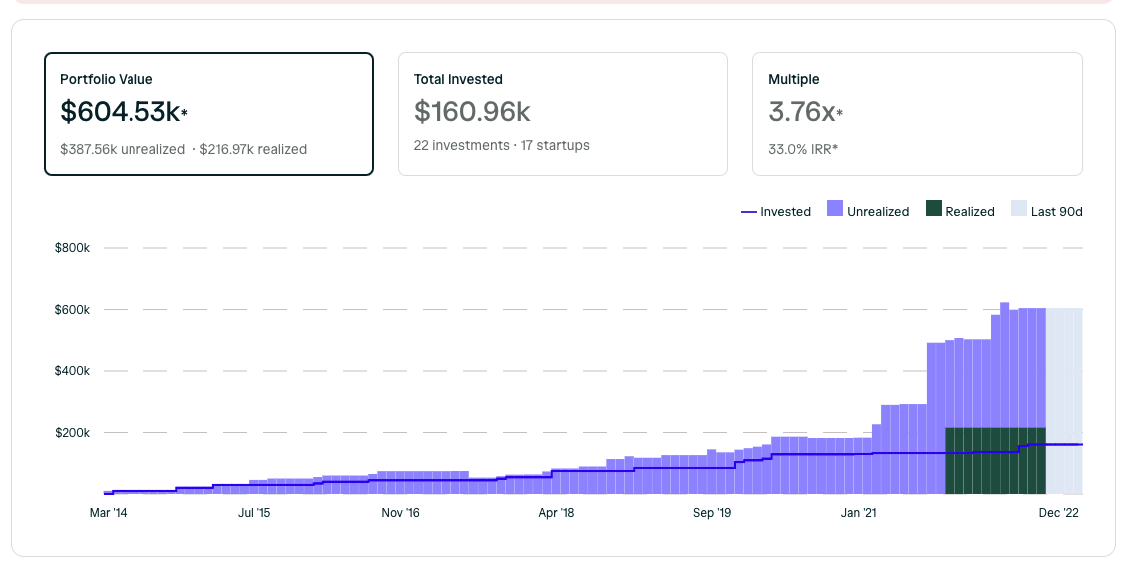

Angel List investment returns on 2022 12 12. Does not include Revolut and some other investments

2017 August. Revolut. Attracted 66M investment at 420M valuation. I got a cash offer to sell my shares at x5. Decided to keep, because i believe Revolut can be 4-40 billion company. With exit from Wefunder and current Revolut and Soothe valuations i am close to break-even.

2018 Summer. Revolut is a unicorn valued at 1.7B. I get 20x cash offer and refuse because i think this can go up 20x more. It can beat Paypal (90B) valuation. Although there is big competition – Cash app from Square is the first one that comes to mind and is run by great founder.

2020 January. Revolut raises 500M at 5.5B valuation. My stake has ~50X value. I was right in 2017 when i said that Revolut can be worth 4-40B

2021 July. Revolut raises Series E and is valued at 33B. My stake has ±300x value.

Technically all my first startup fund is covered only by Revolut. Also my other companies , Italist and Soothe have great paper returns.

My mistake from Fund1 is that i put different amounts to different projects.

I am trying different investment vehicles / asset classes to find out where can i have the edge. Investing in startups was one of them 2014-2016. I have made 9 investments in startups via Angel List, Crowdcube, Seedrs (UK) and Wefunder.

Reading list:

Steve Blank: how to raise money?