I have already had few defaults on EstateGuru and with this post I want to share how the defaults happen and what you can expect. (i have previously shared how Housers manage defaults) The image is my current portfolio stats with the defaults. I have stopped investing in EstateGuru some 6 months ago, as I am currently putting all my Real Estate investments into EvoEstate.

To this date EstateGuru claims they have not lost any principal for the investor. With the rising Real Estate market that was quite easy to sell the defaulted properties for greater value. It is not clear how much does the recuperation of defaulted loans cost for investors. So I give my personal examples:

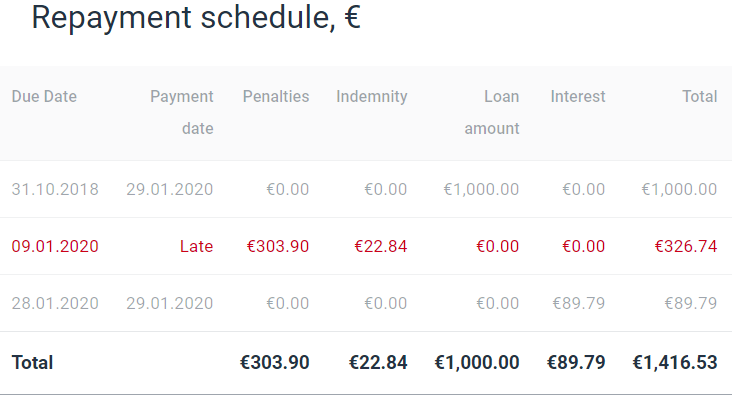

Tiskre residences development loan II. 12 month loan with LTV 57% and expected 10,5% annual interest. I got €89.79 which comes to 8,98% total return in 820 days and annual REAL return less than 4%

I have other 8 loans that defaulted – on the contrary all those 8 have returned bigger return than expected. (That happens because if the borrower is late – he starts being charged 18% annual interest rate.)

How long does it take to recover defaulted loan?

In my experience usually it is about 1 year, but i have properties that take longer. The thing why this happens in my opinion is that EstateGuru does not want to lose investors principal, so they do not lower the auction start price enough.

The last auction failed due to lack of interested buyers. The new auction will be announced soon with same price.