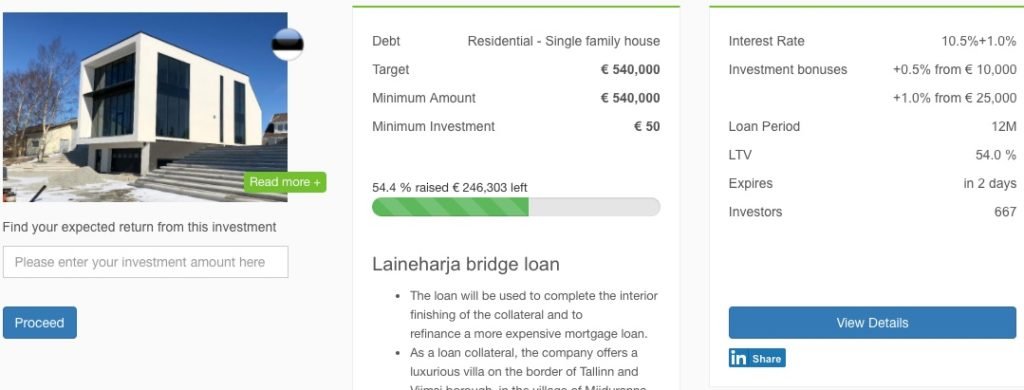

EstateGuru. I have increased my allocation to 7.5% of my net worth in this platform. Turned off the auto-invest and doing investment manually. I have contacted support for improving the service with more abilities to filter the auto-invest settings, but they refused to do that. I see the biggest risk in projects, where collateral is Land (I rarely invest manually to Land collateral) or some risky projects such as:

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it.

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it.

All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.

All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.

EstateGuru is the first P2P lending company I recommend to my friends

Bondora. Doing nothing with the account. Auto-invest is turned off. Waiting for more results from #strategy3. After 15 months from the start of this experiment I am approaching 50% mark of defaults. I know that 60% default rate would still bring me good return, but i have a feeling that i will have 70-80% of default from strategy3. The good thing that i put only 0,5% of my networth into this strategy testing, and still with the 75% default rate i think i would not lose the money.

Mintos. I have increased my allocation in this platform to 2.5% of net worth. I converted to all the possible currencies and split the risk between different platforms, currencies. Majority of operators i took those who offer collateral. The bad thing i did i exchanged too many DKK and 80% of this currency sits idle, and none of investments available in both primary and secondary market.

Twino. My lowest allocation.

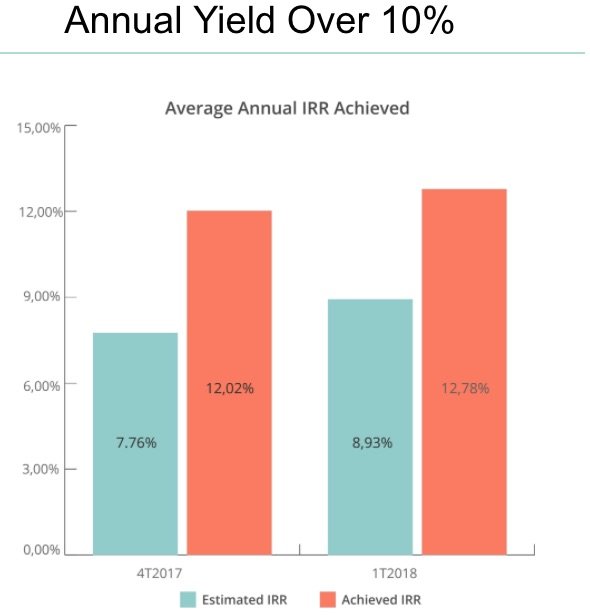

Housers. They are pushing good ads. I liked especially the one that they claim that real returns are greater than expected. Still they do not convince me

I have been looking intensely at crowd-funded real estate. So far I haven’t pulled the trigger because these platforms make money on volume. That is, they have a strong incentive to get as many deals as possible going through their portal rather than having skin in the game with their own capital in each deal–and therefore being choosy. Bottom line–they make more money with high-volume average returns than low volume excellent returns. Maybe its different in Europe? Instead, I look for individual sponsors with expertise in a specific real estate niche and invest alongside them. I’m looking forward to watching how this evolves for you. Looks like so far, so good. Cheers!