The purpose of this post is to understand weather P2P lending in Bondora is good or not.

I have invested 17.000 euros in this ”asset” and even though, Bondora shows 17.56% ROI for me at the moment which is great, i can’t tell if this investment is good or no. Each month i will share results

What worries me is defaults. Current total defaults is 2,254.78€ on 2016 March 7th and it constantly exceeds the profit made.

Basically if i will get 50% of the defaulted investments, i will be in a loss. I will keep updating this page so we will see the progress in Profit vs Defaults.

Also i have found one analytical article on Bondora

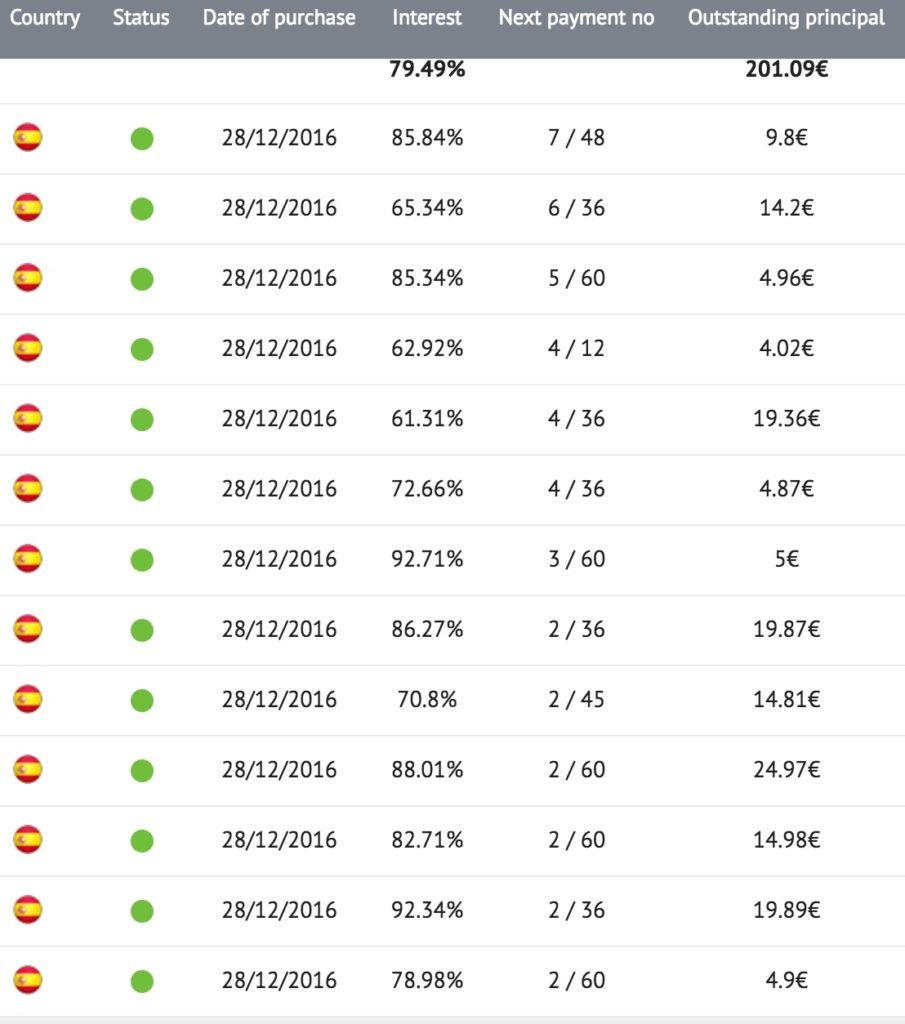

| Date | stated XIRR | expected return | Principal overdue | Defaulted | Profit | Withdrawals |

| March 16, 2016 | 19.08 | 14.24 - 14.61 | 2109 | 1396 | 1070 | |

| April 15 | 19.60 | 14.07 - 15.80 | 2635 | 1489 | 1329 | |

| May 15 | 20.48 | 14.20 - 15.74 | 4052 | 2025 | 1676 | |

| June 15 | 20.59 | 14.33 - 15.69 | 3097 | 2695 | 1981 | |

| July 16 | 20.48 | 14.46 - 16.11 | 3389 | 2704 | 2267 | |

| Aug 15 | 20.56 | 14.53 - 16.52 | 3833 | 3631 | 2585 | |

| Sep 15 | 20.24 | 14.46 - 16.17 | 4530 | 3841 | 2873 | 298 |

| Oct 15 | 20.22 | 14.41 - 16.91 | 3947 | 4184 | 3122 | 300 |

| Nov | | | | | | 1100 |

| Dec 19 | 18.79 | 12.27 - 16.16 | 5386 | 5584 | 3485 | 550 |

| Jan 15 | 18.37 | 11.87 - 15.49 | 6588 | 6372 | 3574 | 0 |

| | | | total | withdrawn | 2248 |

May 15th My newest strategy doesn’t give me many loans to invest in. And the very few i get are oversubscribed. Therefor May 15th there are 446 Euros in unused funds

—

September 15th.

having 20k on account and 20% IRR, theoretically i could take 300+ euros a month, which i started doing.

October 15th (Saturday). First thing i withdraw 300 again, but the interesting thing there are no loans on the market to be funded. Only auto-invest programs can do that. And the rules, unless you use API, to set are very limited. (Compared to Mintos).

December 19th. I have missed the November month. The defaults are still growing massively: they grow more than the profit.

17k deposited. Outstanding principal is 19k out of which 5.5k is defaulted. If i sold non-defaulted loans at their purchase price, I would be at a loss, though my return at the dashboard says 15%+ return.

- the auto invest program sucks. I stopped using it because sometimes when i see AB rating loans defautled, i check them – it is very obvious that they had too good rating – where with my experience i would have marked them as HR.

- one interesting notice: all my current defaults, defaulted on first payment. I do not have any defaulted contracts with second payment.

My defaulted contracts by the purchase date. Hopefully these are the last 🙂

December 22d. By my calculations, and theory that defaults are on first payment, i can say that i have reached (hopefully) that total defaults are 5764€. If my profits at this moment are 3.5k so i should break-even in 5 months from now, and in total it comes 7 months after i stopped investing and starting cashing out. If this happens after 5 months, it means that from then on i will start receiving profit and Bondora is good as a passive investment form. Even if it doesn’t earn double digit rate or return I will have a percentage of my portfolio at Bondora.

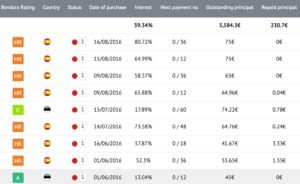

What is the Return on Spanish loans?

assume Spanish loans give 50% interest and 50% of spanish loans default to 0.

so if we have 10 loans for 100€. Total investment is 1000€, with 50% default our loss is 500€. Remaining 5 loans of 500€ in 5 years will generate 868€ + 500€ of principal = 1368€, so total 36,8% during 5 years comes to 6% annual return.

Personal Update 1 (December 27th) from my 75 Spanish loans, 33 have defaulted (44%) and average interest rate is 56% so my expected return on Spanish loans is greater than 10.2% which i think is ok. (44% defaul: 560€ principal on 1000€ investment generates 1068€ in 5 years of interest. total invested 1000, total received in 5 years 1628€. Also this calculation has upside of loan recovery). 7 loans with interest rate 72-76% has no defaults. 7 loans with interest rate 60-64% has 2 defaults, 7 highest interest 72-80% rate loans have 2 defaults as well. If i could reduce the default rate the returns could be drastically bigger

I can say that my manual picks of loans were better, because the defaults are lower than average for that country and the only way i can keep having same is start using the API.

Strategy #3

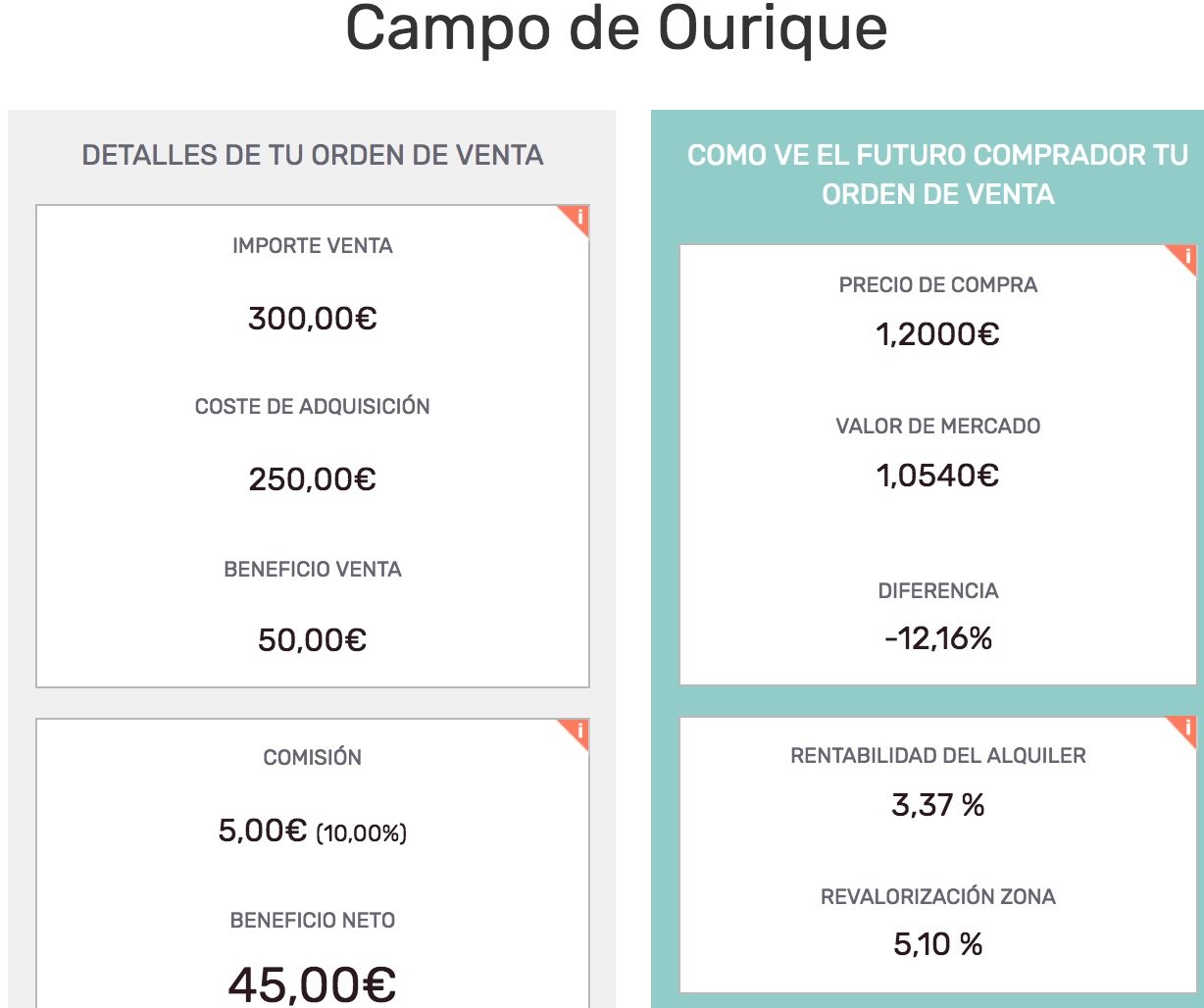

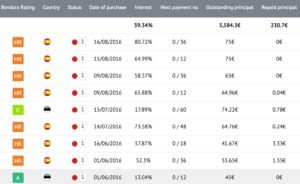

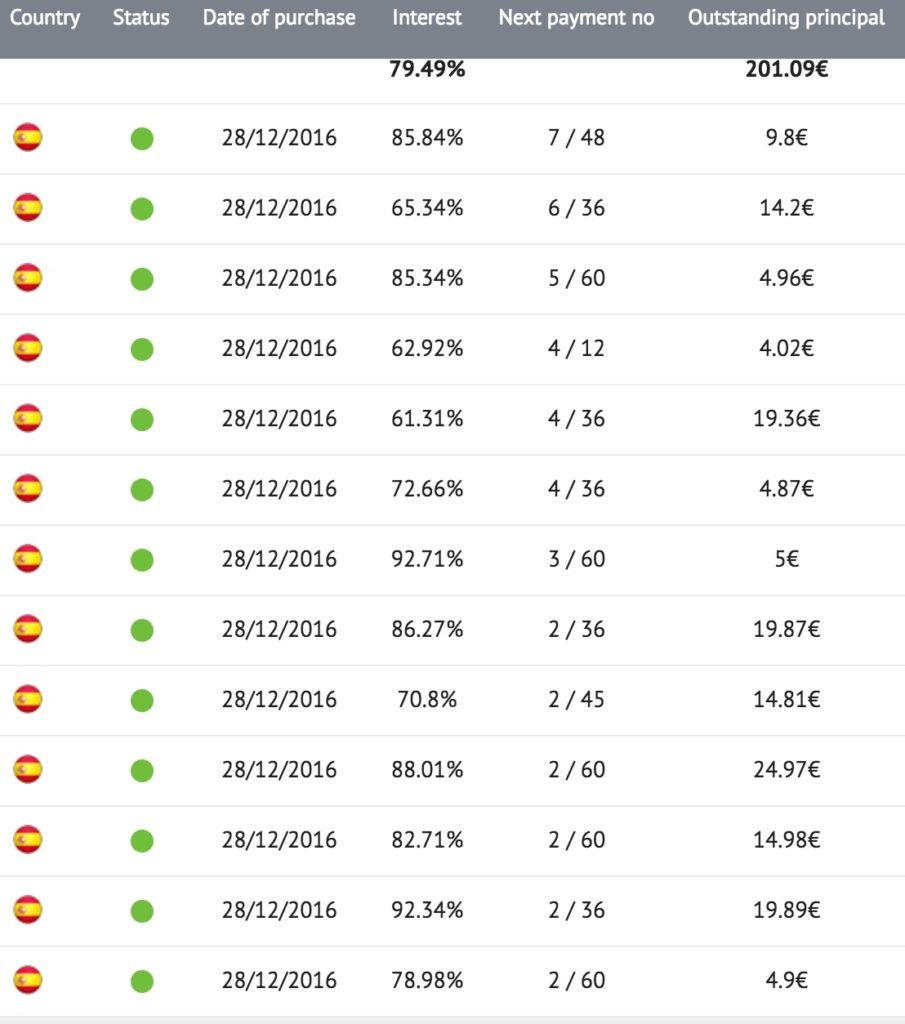

Hand pick Spanish loans in secondary market, that are i

- in at least second payment

- interest rate 50%+

- XIRR 50% +

These are my picks:

I believe i should have none defaults in this group, therefor i could achieve 50-100% yearly returns. I will keep updated on this strategy and if it works – i will need to develop the API, so i don’t have to do that manually.

January 15th

I was shocked to see my defaults increased even though i was not expecting anymore at the end of December, but i have missed something back then. What i am happy about is that my spanish loans with #strategy3 are not overdue or defaulted. I have another 375€ and i will invest them in same strategy:

January 21st

total defaulted loans 6692€

bought another 21 loans on same #strategy3.

from first batch of this strategy none of the loans defaulted

March 16

Total defaults 7235€.

First defaulted loan from #strategy3 with only 10€ of principal. Skip this month investing and will do it in April.

—

Open Account in Bondora