Estateguru is estonian real estate backed p2p lending platform operating in europe: Estonia, Latvia, Lithuania, Germany and Finland. I am investing in platform since 2017 October.

My current return with the platform is 11%+

Registration. Super easy. You upload all copy of your passport, fill in the fields make a wire transfer and you are done.

AutoInvest

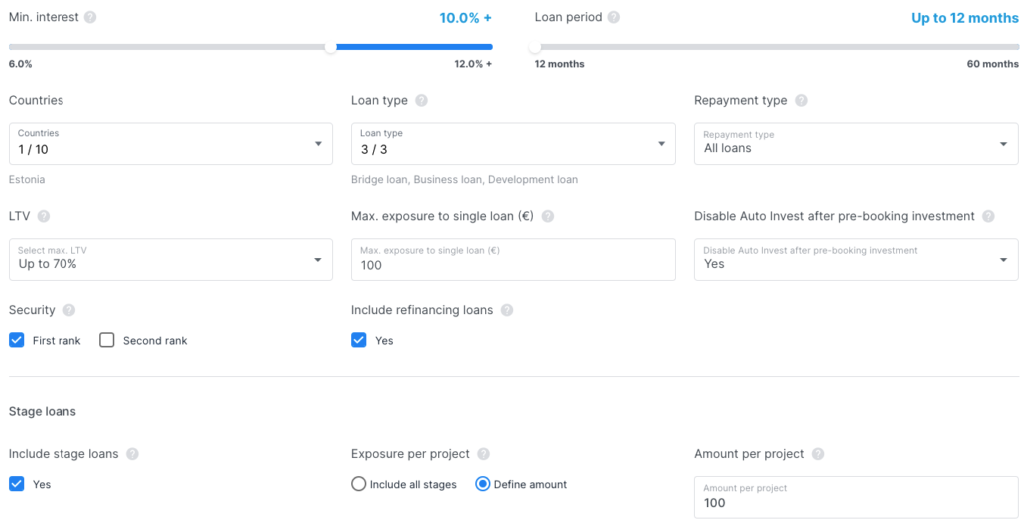

You can select 2 automatic autoinvest strategies and you can have a custom strategy. Currently I have a custom strategy: 10%+ interest, <12 months duration and only Estonia.

Pros. Backed by real estate. The valuations are normal in my opinion. I am familiar with Lithuanian market and everything makes sense. Additionally the valuations of the properties are made by reputable companies like Colliers International or Oberhaus. (usually those big name companies give lower valuations so investor protection is even better) (In contrary Housers valuations are not)

Cons. Poor performance in non-local markets such as Germany and Finland.

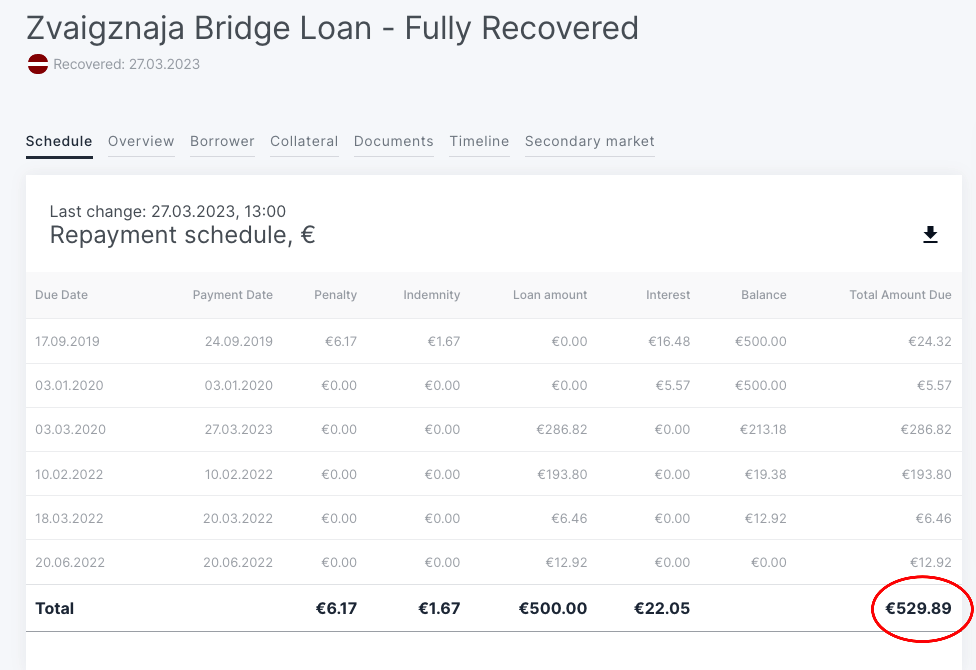

Defaults. Default recovery can take up to 5 years. Sometimes your earn more from defaulted projects than expected and sometimes your earn less. For example one defaulted project that I had which was 65% LTV, the final IRR was 1%. To this date i had only one project which did not bring full principal back.

29 euro return in ~5 years on 500 euro investment.

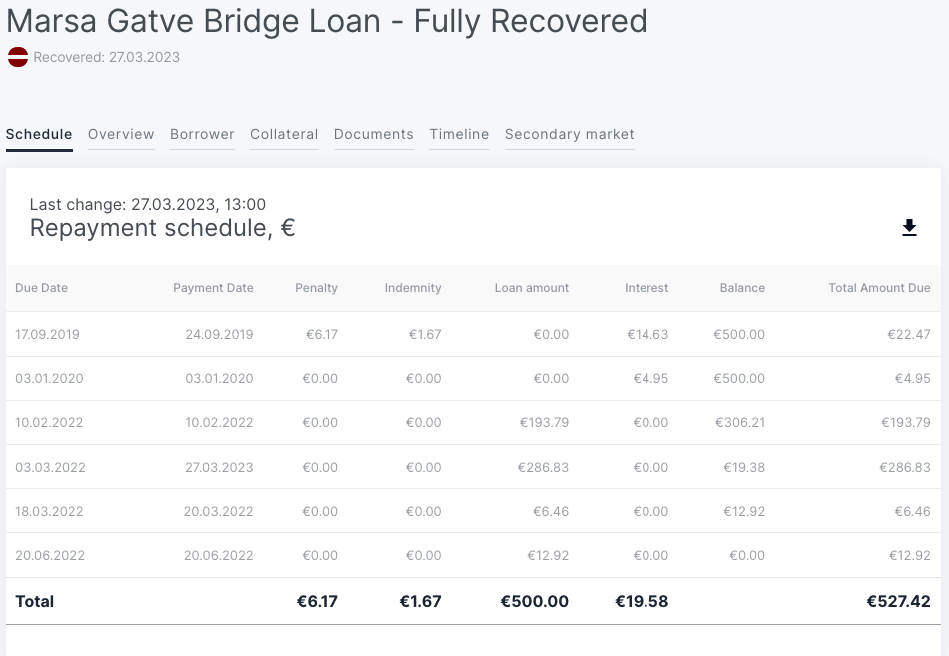

Another similar example:

People behind the project. Marek Partel

How are investments secured. All the loans are backed with a first rank mortgage. The mortgage is held by an entity which is separated from Estateguru.