The purpose of this post is to understand weather P2P lending in Bondora is good or not.

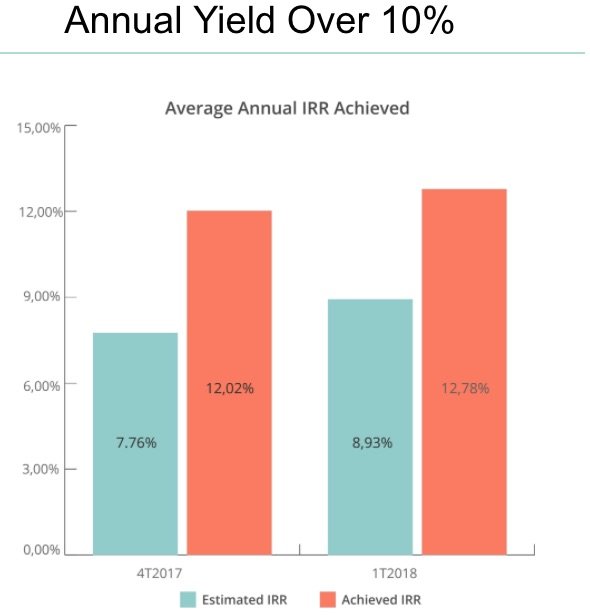

I have invested 17.000 euros in this ”asset” and even though, Bondora shows 17.56% ROI for me at the moment which is great, i can’t tell if this investment is good or no. Each month i will share results

What worries me is defaults. Current total defaults is 2,254.78€ on 2016 March 7th and it constantly exceeds the profit made.

Basically if i will get 50% of the defaulted investments, i will be in a loss. I will keep updating this page so we will see the progress in Profit vs Defaults.

Also i have found one analytical article on Bondora

| Date | stated XIRR | expected return | Principal overdue | Defaulted | Profit | Withdrawals |

| March 16, 2016 | 19.08 | 14.24 - 14.61 | 2109 | 1396 | 1070 | |

| April 15 | 19.60 | 14.07 - 15.80 | 2635 | 1489 | 1329 | |

| May 15 | 20.48 | 14.20 - 15.74 | 4052 | 2025 | 1676 | |

| June 15 | 20.59 | 14.33 - 15.69 | 3097 | 2695 | 1981 | |

| July 16 | 20.48 | 14.46 - 16.11 | 3389 | 2704 | 2267 | |

| Aug 15 | 20.56 | 14.53 - 16.52 | 3833 | 3631 | 2585 | |

| Sep 15 | 20.24 | 14.46 - 16.17 | 4530 | 3841 | 2873 | 298 |

| Oct 15 | 20.22 | 14.41 - 16.91 | 3947 | 4184 | 3122 | 300 |

| Nov | | | | | | 1100 |

| Dec 19 | 18.79 | 12.27 - 16.16 | 5386 | 5584 | 3485 | 550 |

| Jan 15 | 18.37 | 11.87 - 15.49 | 6588 | 6372 | 3574 | 0 |

| | | | total | withdrawn | 2248 |

May 15th My newest strategy doesn’t give me many loans to invest in. And the very few i get are oversubscribed. Therefor May 15th there are 446 Euros in unused funds

—

September 15th.

having 20k on account and 20% IRR, theoretically i could take 300+ euros a month, which i started doing.

October 15th (Saturday). First thing i withdraw 300 again, but the interesting thing there are no loans on the market to be funded. Only auto-invest programs can do that. And the rules, unless you use API, to set are very limited. (Compared to Mintos).

December 19th. I have missed the November month. The defaults are still growing massively: they grow more than the profit.

17k deposited. Outstanding principal is 19k out of which 5.5k is defaulted. If i sold non-defaulted loans at their purchase price, I would be at a loss, though my return at the dashboard says 15%+ return.

- the auto invest program sucks. I stopped using it because sometimes when i see AB rating loans defautled, i check them – it is very obvious that they had too good rating – where with my experience i would have marked them as HR.

- one interesting notice: all my current defaults, defaulted on first payment. I do not have any defaulted contracts with second payment.

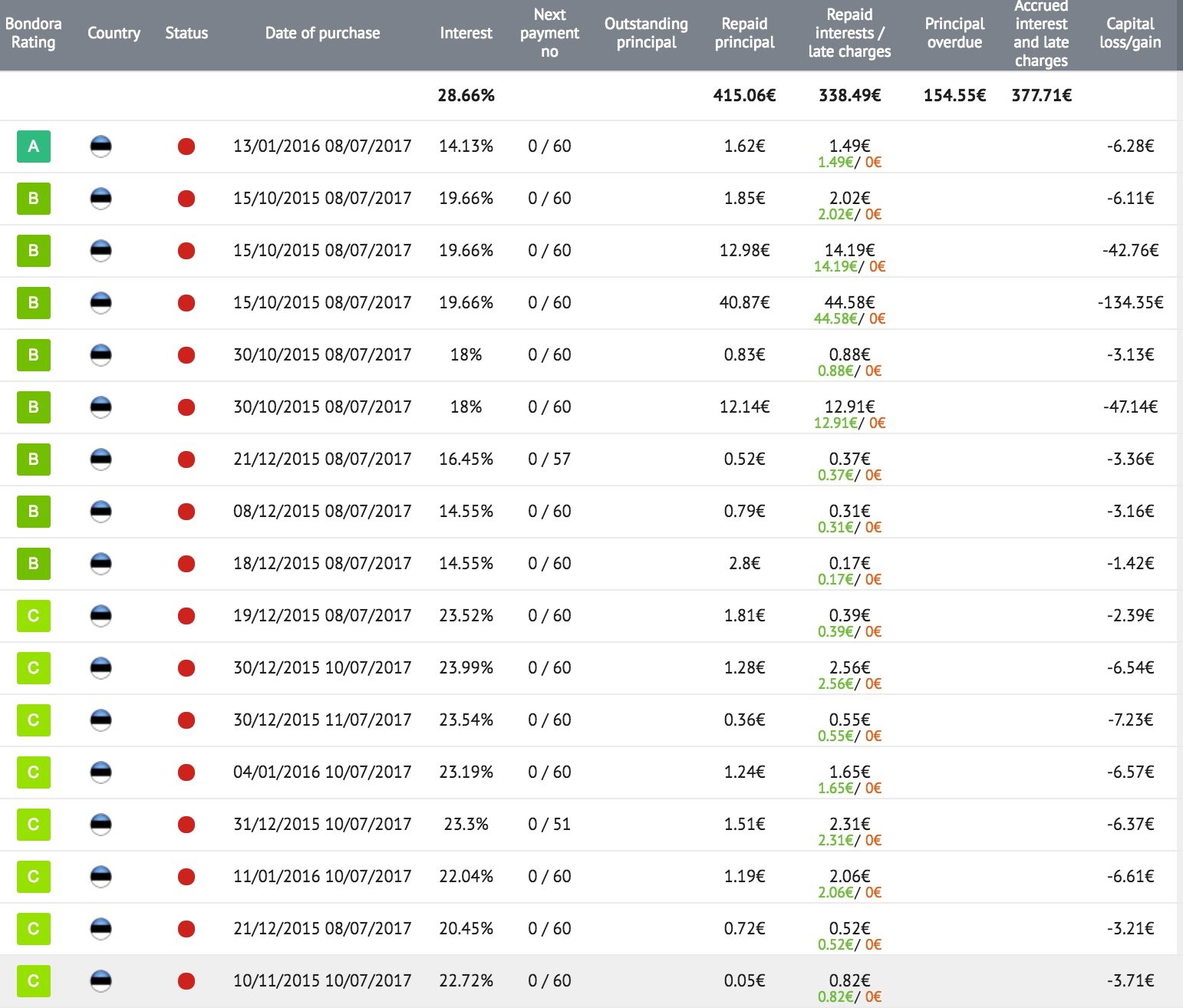

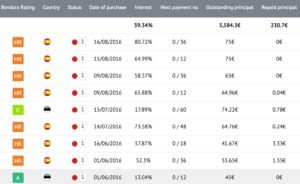

My defaulted contracts by the purchase date. Hopefully these are the last 🙂

December 22d. By my calculations, and theory that defaults are on first payment, i can say that i have reached (hopefully) that total defaults are 5764€. If my profits at this moment are 3.5k so i should break-even in 5 months from now, and in total it comes 7 months after i stopped investing and starting cashing out. If this happens after 5 months, it means that from then on i will start receiving profit and Bondora is good as a passive investment form. Even if it doesn’t earn double digit rate or return I will have a percentage of my portfolio at Bondora.

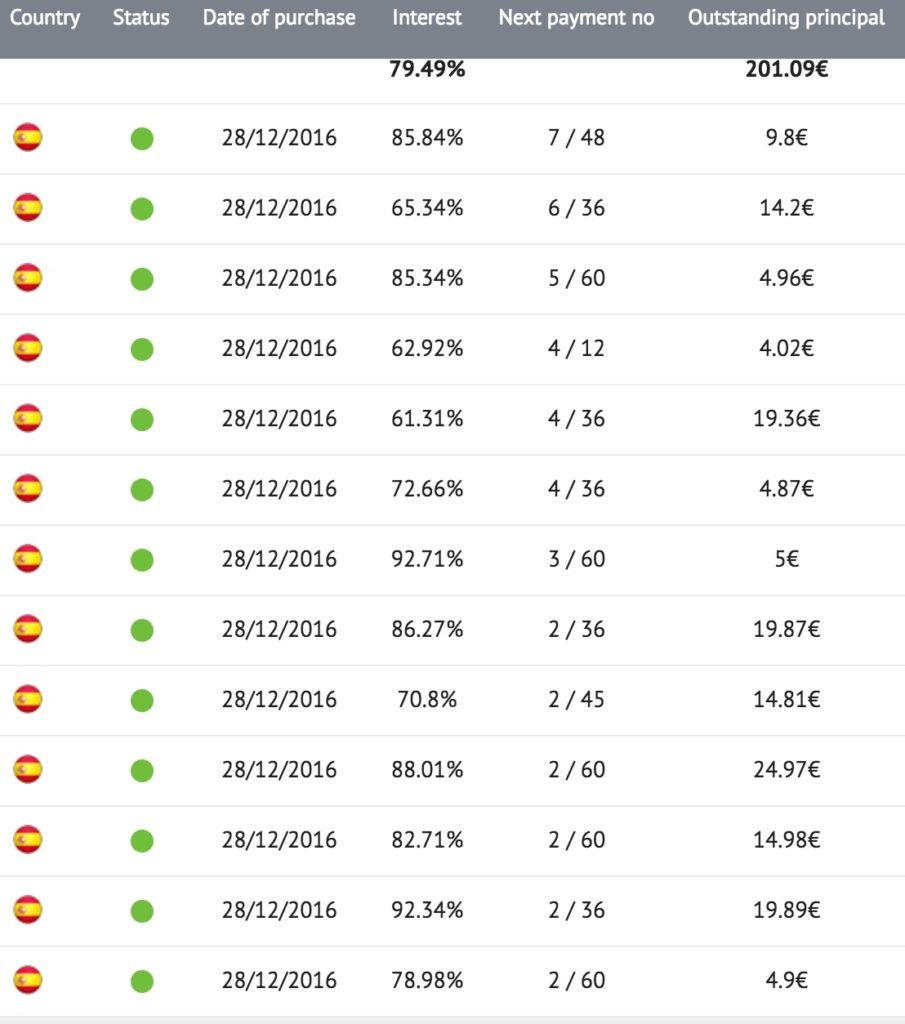

What is the Return on Spanish loans?

assume Spanish loans give 50% interest and 50% of spanish loans default to 0.

so if we have 10 loans for 100€. Total investment is 1000€, with 50% default our loss is 500€. Remaining 5 loans of 500€ in 5 years will generate 868€ + 500€ of principal = 1368€, so total 36,8% during 5 years comes to 6% annual return.

Personal Update 1 (December 27th) from my 75 Spanish loans, 33 have defaulted (44%) and average interest rate is 56% so my expected return on Spanish loans is greater than 10.2% which i think is ok. (44% defaul: 560€ principal on 1000€ investment generates 1068€ in 5 years of interest. total invested 1000, total received in 5 years 1628€. Also this calculation has upside of loan recovery). 7 loans with interest rate 72-76% has no defaults. 7 loans with interest rate 60-64% has 2 defaults, 7 highest interest 72-80% rate loans have 2 defaults as well. If i could reduce the default rate the returns could be drastically bigger

I can say that my manual picks of loans were better, because the defaults are lower than average for that country and the only way i can keep having same is start using the API.

Strategy #3

Hand pick Spanish loans in secondary market, that are i

- in at least second payment

- interest rate 50%+

- XIRR 50% +

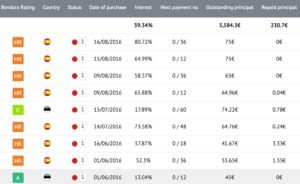

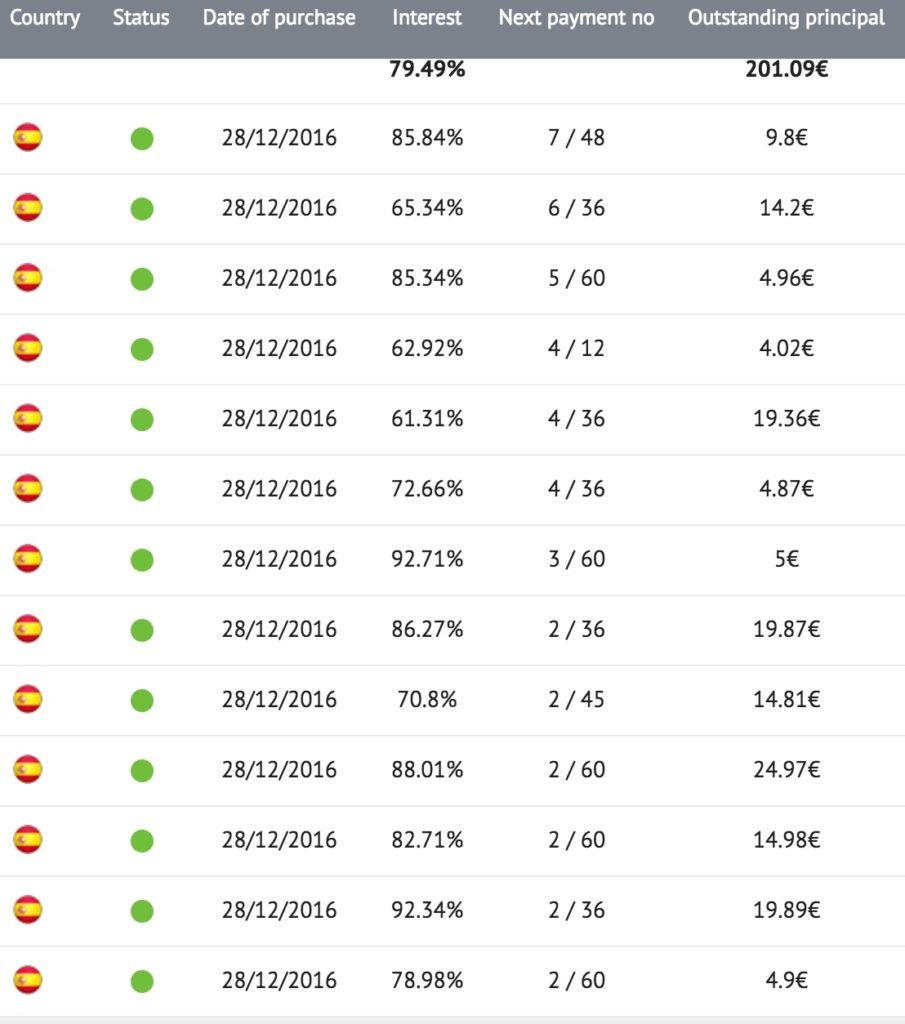

These are my picks:

I believe i should have none defaults in this group, therefor i could achieve 50-100% yearly returns. I will keep updated on this strategy and if it works – i will need to develop the API, so i don’t have to do that manually.

January 15th

I was shocked to see my defaults increased even though i was not expecting anymore at the end of December, but i have missed something back then. What i am happy about is that my spanish loans with #strategy3 are not overdue or defaulted. I have another 375€ and i will invest them in same strategy:

January 21st

total defaulted loans 6692€

bought another 21 loans on same #strategy3.

from first batch of this strategy none of the loans defaulted

March 16

Total defaults 7235€.

First defaulted loan from #strategy3 with only 10€ of principal. Skip this month investing and will do it in April.

—

Open Account in Bondora

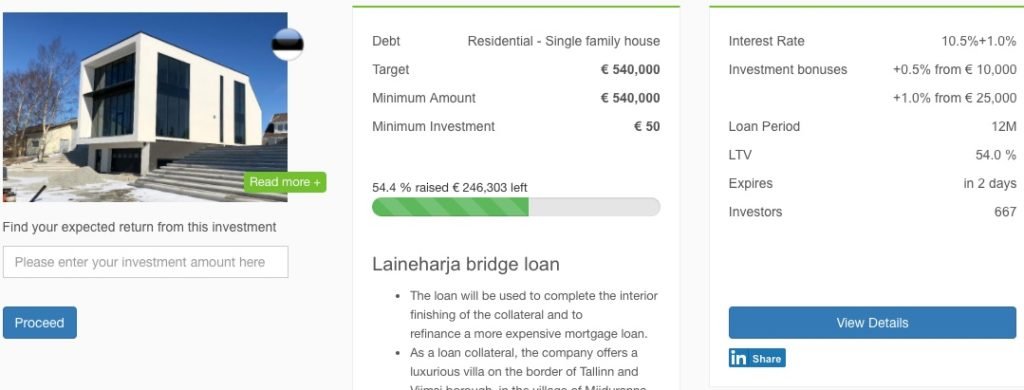

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it.

€1.000.000 house 30 minute drive from Tallinn. I am pretty sure that if this house was offered 50% discount from current valuation it would take months to sell it. All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.

All the projects in Curonian Spit are extremely sensitive. The biggest risk with such projects is Government. The numbers might be right, but if they do not get a permit (which by law they technically should get in X amount of time) the numbers fall apart.