UPDATE. (2019) You can not buy USD Index funds in InteractiveBrokers if you are EU citizen/company.

ERROR REPORT:

“BUY 16 CHIC ARCA @ 23.89” No Trading Permission, Customer Ineligible; Ineligibility reasons: This product is currently unavailable to

clients classified as retail clients. Note: Individual clients and entities that are not large institutions

generally are classified as retail clients. There may be other products with similar economic characteristics that are available for you to trade.

So I got some cash idle in account after the crypto arbitrage and though we have 9 year bull market and even such tables:

Perspective: S&P500

1997 -2000 +2x

2000 -2002 -50%

2002 -2007 +2x

2007 – 2009 -50%

2009 -2018 +~3x

I still believe there is 50/50 chance for Bull/Bear market in next 10 years. (currentS&P500 is @ 2767)

My initial idea with stock market was to make an passive index myself, buying stocks from S&P500 for the same amount. Buy i noticed it takes too much time, so i decided to go for the index funds and delete the IB trader app from my laptop.

The problem: foreigners can not buy low cost Vanguard index funds. The solution: I decided to buy iShares ETFs by BlackRock.

I have chosen:

- ITOT Expense ratio 0.03%. (6.6% of my stock portfolio)

- IJR Expense ratio 0.07%. (15% of my stock portfolio) (Small cap companies)

- ICOL Expense ratio 0.61% (9% of my stock portfolio) (Columbia)

- QQQC Expense ratio 0.65% (10% of my stock portfolio) (Chinese tech companies)

My current strategy is to continue investing in P2P loans with collateral, after the market crash of 20%+ start accumulating ITOT.

- 40% of my stock portfolio is invested in indexes/ETFs

- 9% of my net worth is invested in stock market.

- 6.8% of all stock portfolio is in Softbank

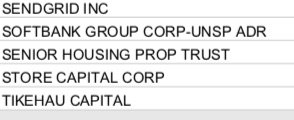

Currently i hold these stocks:

Hello,

I stumbled upon your article when I was looking for ways to invest in the S&P 500. I have a question:

I heard it is not a good idea to invest in this index if one is basically looking for dividend passive income as the dividend annual yield is only about 3% max. Is that true ? what is your suggestion for stock market passive income with high returns ?